Hi, I’m going to be talking about cash-on-cash return in real estate explained simply. Read Our post cash on cash return in real estate and post your opinion below also share it on social media.

Many Re Investing Metrics

In case you haven’t noticed there is a dizzying array of financial metrics in the real estate investing world.

Out of all these financial metrics, there’s three that really have remained the tried-and-true those are Noi, Cap rate and cash on cash return.

The Cap rate and the cash-on-cash return are incredibly similar.

Yearly % Received In Rent

If you don’t know what a cap rate is essentially the yearly return that you receive through rental income.

But the cap rate has a fatal flaw; it doesn’t calculate the mortgage for the property or fact that almost all real estate investors do. Especially commercial real estate investors are going to be using long-term debt or mortgages to finance the property.

3.5% Vs.4% Loan Rate

Let’s say for instance you had to choose between a 4% loan and a 3.5% loan and you had the choice between putting 20% down and 10% Down.

As you can see these varying types of loans can have drastic effects on your returns and this is where cash-on-cash return comes into play.

Mortgage Drastically Effects Returns

When you calculate things like different rates, different down payments, and different loan amortization structures and loans in general.

You have to include the cash on cash return when you are doing your rate of return.

Do you calculate cash on cash return?

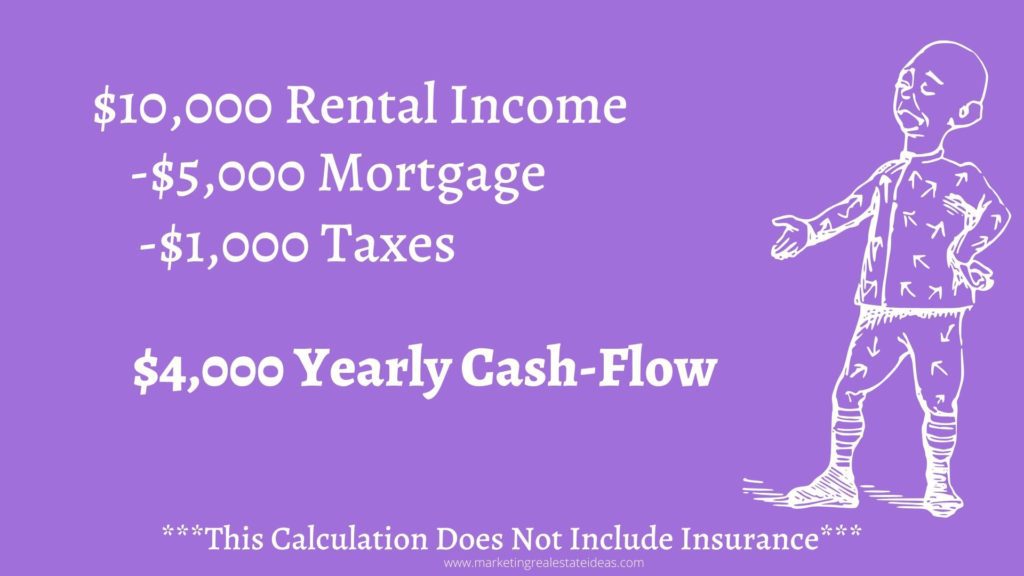

Well, the cash on cash return is the yearly cash flow divided by the down payment. Say we have three things here.

$10,000 in yearly income, we have a $5,000 yearly mortgage and we have $1000 in yearly taxes on a single-family residence that we have just purchased.

So in order to calculate the cash flow to take the yearly income, we have to subtract the mortgage and then we have to subtract the taxes going to give us $4,000 in cash flow for that year.

So had a $100,000 property that we purchased and we put 20% down on it that’s going to be $20,000 and that’s going to be our down payment.

20% Cash on Cash Return

In this hypothetical example, we get a 20% cash-on-cash return and in my area, a 20% cash-on-cash return is going to be more than acceptable.

But this could vary depending on your location and your standards of what a good investment is.

Real Estate Cash on Cash is Always Higher

Notice that cash-on-cash returns are almost always more than cap rates and this is simply because. The mortgage on a property or the financing of the property actually increases your return.

More Returns = More Risk

At the same time, it also increases the risk which is seen universally across the board with all investments.

What is “Risk” in Real Estate?

Well, when you hold a mortgage on a property there are many things that could go wrong.

Let’s say a tenant moves out and the yearly income that you receive for those few months is totally gone and you get hit month after month with a mortgage.

If that mortgage payment continually hits you and wipes out the cash reserves you may actually go bankrupt on the property and get foreclosed upon.

So that is where a lot of the factors of risk come involved when you actually finance a property.