Today we’ll talk about three ways to first time home buyer loans with zero down nothing niche nada nothing it’s completely free for you to buy the home you move right in I’m not BSN you guys I’ve done it twice myself now stay tuned.

I want to talk about three ways to buy a home with no money down now there are actually quite a few different ways to go about doing this but these are the three most common ways one of them I’ve done myself twice now and the other ones I’ve helped clients do as well.

What these are different loan programs that you can do to qualify for that mortgage some of these are backed by the government to help encourage growth in certain areas or to help certain groups of people like veterans get into homes.

First-time Homebuyer down payment

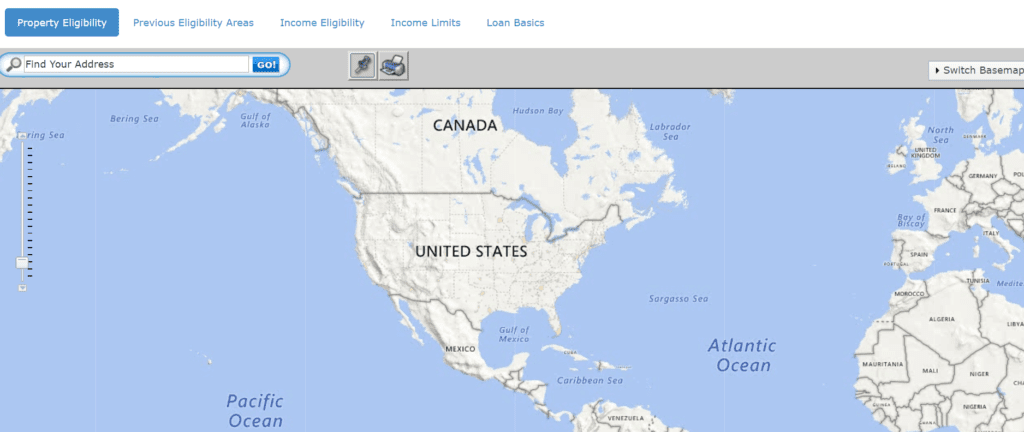

So the first one we’ll talk about is the USDA urban development loan so this loan is backed by the USDA and it’s helped encourage growth in the development of more rural areas. Now there are two major criteria to qualify for this loan one is you can’t make too much money and what too much is determined by is this county and the state that you live in right so you have to be under a certain income to qualify for this loan to find out what criteria you just go online and you can go on the USDA’s website and punch in your numbers and they’ll tell you if you qualify if you make too much money to qualify for this loan.

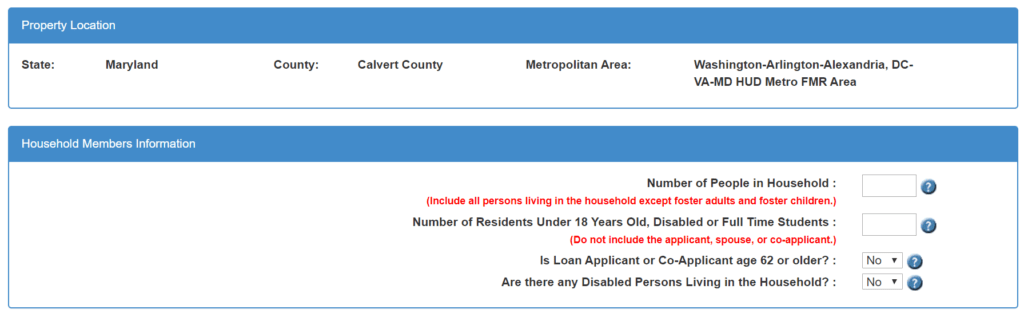

Single Family Housing Income Eligibility

The next major criteria are that this loan is only eligible in certain areas of the deme rural now there’s actually a map on their website again that you can go to and you can search for the different areas that they consider rural.

I gotta be honest you’re pretty flexible with this term morale there are quite a few areas that I didn’t consider rural but they are actually eligible for a USDA loan.

VA loan

So next let’s talk about the VA loan this is what I’ve done twice now so the VA loan you have to be a veteran to be eligible for this and it’s backed by the Veterans Association the VA and once again allows you to purchase a home with zero money down towards that purchase.

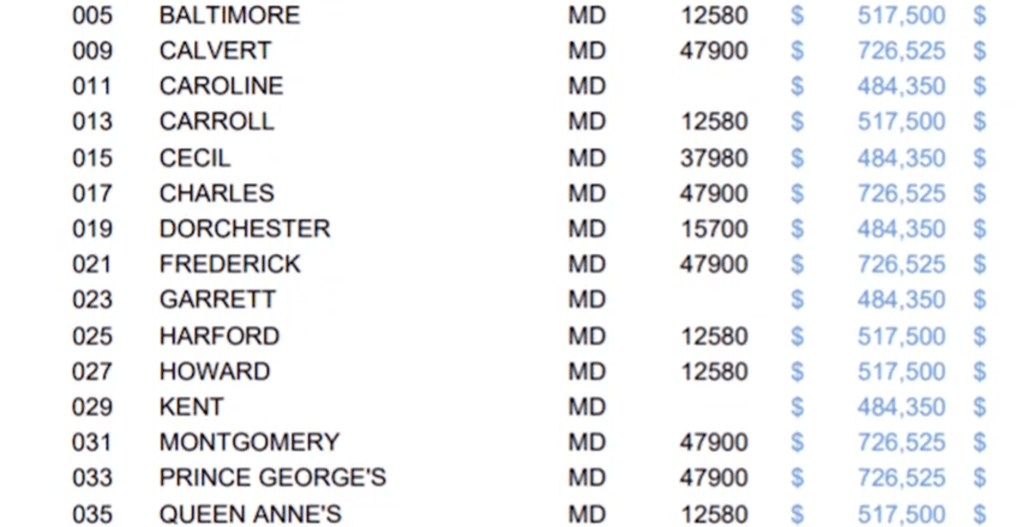

So how the VA alone works are that your maximum purchase amount is based on the county that you’re purchasing in so here

housing costs in the Maryland

In Maryland, we have above-average housing costs in the Maryland and MD area so our county actually has a very high maximum purchase price and they call this your VA entitlement your maximum VA entitlement. Now it’s important to note that just because your maximum VA entitlement maybe let’s say six hundred thousand it doesn’t mean you qualify for a six hundred thousand dollar loan your lender is still gonna look at your income your credit history your debt to income ratio these things to see if you can qualify for a purchase of that heíd so here’s what’s interesting though about the VA alone is that let’s say you have a six hundred thousand dollar maximum VA loan that doesn’t have to be on one property.

So I bought my first property for two hundred ten thousand dollars in Anne Arundel County here in Maryland the maximum VA entitlement for that county is five hundred and seventeen thousand so that means that I still have quite a bit almost three hundred thousand dollars of VA entitlement remaining.

I was then able to move out of that home turn that into a rental property and then buy a second property for two hundred and forty thousand dollars and because both of these properties combined or under the maximum VA entitlement of 517,000 I was able to buy both of those with zero down.

FHA loan

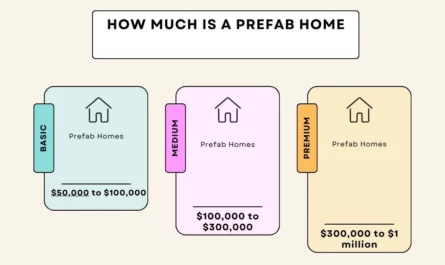

So the final way to purchase a home is zero down is the FHA mortgage program and an FHA loan typically requires three point five percent down towards the purchase price but there’s a caveat that you can have that money gifted to you.

If you’re a first-time homebuyer and you want to have that downpayment gifted to you from your parents your grandparents or sibling something like that you can absolutely do that and then you can move into the property with zero down.

First-time Homebuyer Program

So something to note though just because all three of these mortgage programs allow you to purchase a home without anything down towards the purchase price you still have closing costs. So the buyer is typically responsible for anywhere between three to three-and-a-half percent of the purchase price in closing cost so these are various taxes and fees by the state and the title company now what you can do though is negotiating in your offer to have the seller cover your closing cost.

This is what I did when I purchased both of my properties what I do for a lot of my buyers and sometimes when you do this though you have to offer them above asking price. so if they’re asking $300,000 for the home and that’s what the home is actually worth you might have to offer them three hundred nine thousand dollars with them giving you nine thousand dollars back and closing cost assistance in order to cover all your closing costs and this is essentially a way of you wrapping your closing cost into the mortgage.

12 thoughts on “First Time Home Buyer Loans With Zero Down Payment”