Let’s go over 6 ways in which a home equity line of credit works to help you make a well-informed decision. Read this full post and You will definitely like it and Share it on social media channels.

- 1. What Is A Home Equity Line Of Credit (HELOC)

- 2. How Does A Home Equity Line Of Credit Work

- 3. How Does A Home Equity Line Of Credit Impact Your Credit Score

- 4. Common Reasons Why People Get A Home Equity Line Of Credit

- 5. Five Common Reasons Not To Get A HELOC

- 6. Differences between Home Equity Loan Vs. Home Equity Line

As you can imagine there are a lot of different pros and cons that go into the considerations of exploring your home equity line of credit options.

There are some good things that could happen as a result and there are some bad things that could happen if you’re not prepared.

So here’s what you’re gonna learn after our conversation today.

1. What Is A Home Equity Line Of Credit (HELOC)

So let’s leave it with the first one which is a home equity line of credit also known as a HELOC.

In short, a home equity line of credit is a second mortgage that in many cases will provide up to 85% of your equity amount in your home.

Now it is important to note that amount that you can draw out of your equity will vary from lender to lender.

Make sure that you explore those options with each lender that you’re considering having a home equity line of credit with you to know how much you can cash out at your property.

85% That You Could Get Out Your House

Now when we’re talking about the 85% that you could get out of your house.

It is important to note that we’re going to be looking at the current property value of your house.

And then you look at 85 percent of that amount minus your mortgage owed.

The difference between what your home is worth – how much is owed on the property is known as your equity.

That’s the portion they’re going to be looking at giving the 85 percent or again it varies from Leonard.

Major Reasons Why People Think

A couple of major reasons why people think about getting a home equity line of credit are for home renovation projects or if an emergency situation happens.

Second Mortgage On Your Home

Yeah, one of the biggest reasons that people don’t get a home equity line of credit is the simple fact that it is like a second mortgage on your home.

And what happens if you can’t afford the new payments?

To get a home equity line of credit typically a lender will be looking for you to have a debt-to-income ratio in the low 40s if not less.

Credit Score Of 620 Or Over

Also, a credit score of at least 620 is above.

And you have a value in your home of 10 to 20 percent greater than what you owe on your home.

These are minimum threshold and again it will vary from lender to lender the best way to explore those options are with a loan officer.

2. How Does A Home Equity Line Of Credit Work

So now let’s explore how does a home equity line of credit works.

The easiest way to understand a home equity line of credit is essential to think about it as a credit card for your house.

Is literally like you’re saying:

“Oh thank you house you’ve paid me all this equity and now I’m gonna use you like a credit card”

Now we know that credit card usage done incorrectly is not a smart idea.

So I always stress the people when they’re considering a home equity line of credit.

Ensure they’re making a well-informed decision and explore all financial options prior to touching the equity in your home.

How This Works

Let’s go over an illustration of how this works.

Let’s say that your home is $500,000 and that you have a mortgage balance of roughly $300,000.

If you can get up to 85% of the value of your home from a specific lender.

That would mean that you’d have the potential of a $125,000 home equity line of credit.

Let’s bring this ‘life with a little bit of math‘

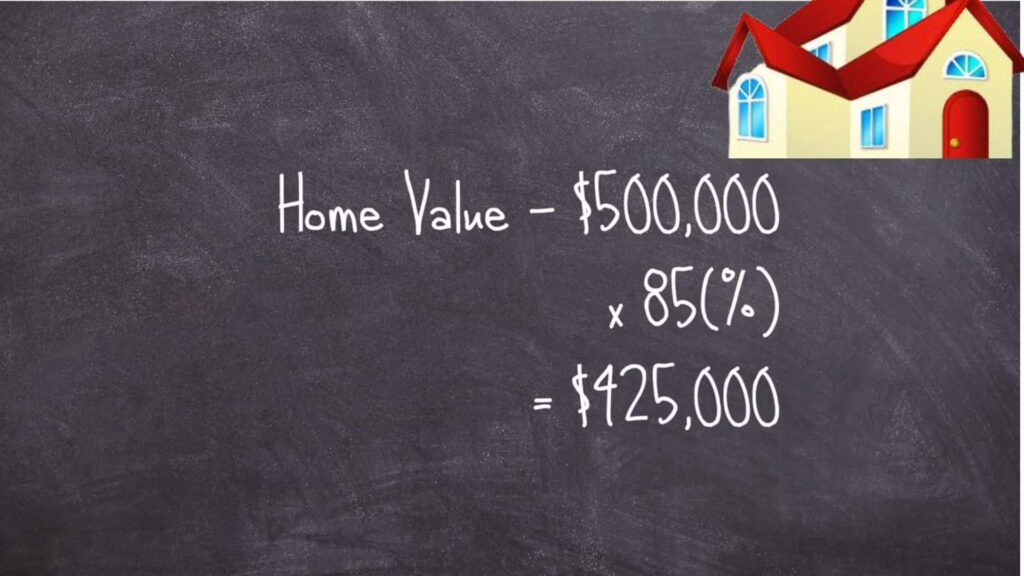

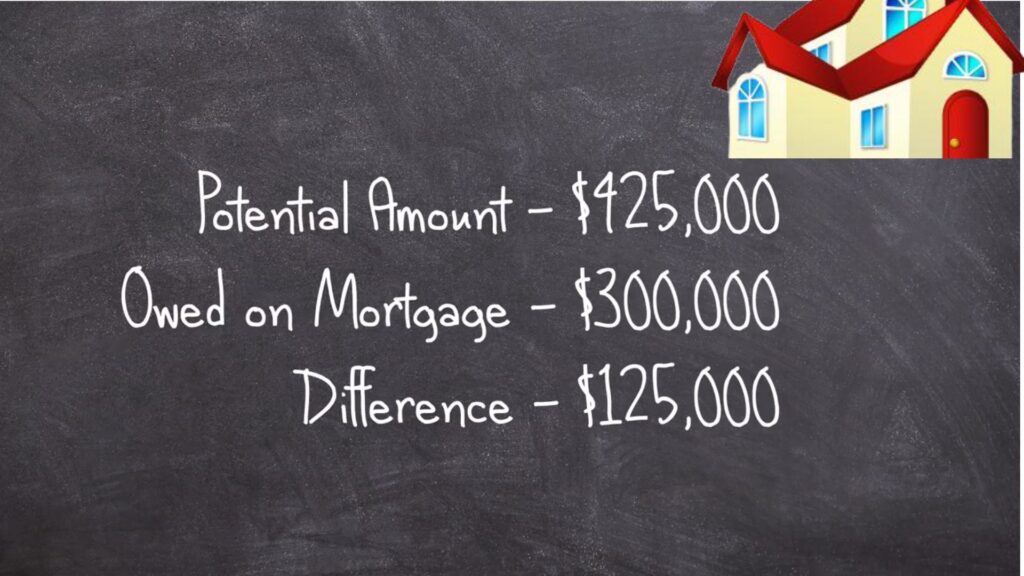

Take your home to this valued at five hundred thousand eighty-five percent the result is four hundred and twenty-five thousand.

Take the four hundred twenty-five thousand dollar amount that you could potentially tap into and subtract it from the amount that you owe on your mortgage which is three hundred thousand dollars.

That leaves you with the difference of a hundred and twenty-five thousand dollars.

“The one hundred twenty-five thousand becomes your maximum amount of line of credit that you could get in this example.”

Variable Interest Rates

Note: That a lot of home equity lines of credit do have variable interest rates.

This means the interest rate could change up to or down, to understand more about how that works please talk it over with your loan officer.

3. How Does A Home Equity Line Of Credit Impact Your Credit Score

Which will take us to the third point how does a home equity line of credit impact your credit score?

Even though your home equity line of credit kind of behaves like a credit card when it comes to your home.

Different credit bureaus view this a little bit differently.

In this sense that they won’t account for it as revolving debt, they may look at it as an installment debt.

What That Means

What that means is that even if you borrow a hundred percent of the total amount available to you through the home equity line of credit.

It might not have a negative impact on your credit score.

Yeah, it is important that I understand that like any other line of credit having a brand-new home equity line of credit might dip your credit score slightly in the beginning.

Yeah, it is important to understand that like any other new line of credit getting a newer home equity line of credit will likely cause your credit score to reduce at least in the temporary short-term future.

4. Common Reasons Why People Get A Home Equity Line Of Credit

The fourth thing to note is what are the common reasons why people would get a home equity line of credit.

There are reasons that this does make sense from time to time.

- Sometimes it could be for emergency bills.

- Sometimes it could be used as a college fund for one of your loved ones.

- Sometimes people will use this for home improvements or renovations when they’re getting ready to sell their house.

I Would Strongly Urge You

Now I would strongly urge you that if that is the case you want to do home improvements or renovations for the purpose of selling that house.

To work with your trusted real estate adviser one to two years in advance and to please complete those repairs one or two years in advance.

To help you maximize the potential return on those renovation projects.

That being said those are very common reasons why people choose a home equity line of credit.

Now obviously this isn’t going to be a wealth-building tactic.

HELOC Could Be Tax-Deductible

Sidenote: The interest on your home equity line of credit could be tax-deductible.

Please review that with your tax advisor to see if that’s gonna be your case too.

5. Five Common Reasons Not To Get A HELOC

Now let’s take a closer look at five reasons that you would not want to have a home equity line of credit.

- Your Income Isn’t Stable.

- The Upfront Costs Are Too High.

- You Don’t Need A Big Loan

- You’re Concerned About Fluctuating Intrest Rates

- You Need It For Basic Needs

6. Differences between Home Equity Loan Vs. Home Equity Line

The sixth thing is understanding the differences between a home equity loan vs. a home equity line of credit.

Remember that your home equity line of credit kind of behaves like a credit card with a revolving balance.

Letting you tap into the equity as you need it moving forward.

Whereas a home equity loan is going to give you a massive lump sum of money up one time this gets pretty darn risky for a lot of people.

So please make sure that you make the most prudent decisions that are right for you.

Difference Is The Home Equity Line Of Credit

The biggest difference is the home equity line of credit behaves like a credit card you tap into it as you need it.

Difference Is The Home Equity Loan

A home equity loan is that you get one lump sum at one time that’s payback and install my mouse over time.

While a home equity line of credit has a variable rate kind of like credit cards do.

It is also important to note that a home equity loan is generally a fixed rate which can save you a lot of money in the future as well.

You’ll want to review your options with a local loan officer to ensure that you’re making a smart move for yourself.

So, I hope you like this article, and please like & share this post on social media channels.

One thought on “6 Ways How Does A Home Equity Line Of Credit Works”